Foreign Visitor's Policy inside Iran

Iran insurance company (Bimeh Iran) wishes you a very safe and sound journey.

Any material and/or bodily damage must be reported – not later than 72 hours after the incident.

Dear client, please carefully read the contents of the policy and the booklet.

Note: In line with provisions of the Supplement Condition, should the insured intend to cancel this policy the due request must be submitted to Bimeh Iran within six months from the issuance date. Otherwise the policy shall continue to be in force and the premium un-refundable. Bimeh Iran secures your peace of mind on your trips.

The services covered by this policy:

- Payment of medical, surgical and poisoning treatment costs.

- Transfer and admission to the nearest hospital in Iran.

- Repatriation of minors to their respective countries in the event of insured's hospitalization or death.

The services subject to this policy shall be extended to the insured, on the basis of the annexed general conditions, all over the territory of the Islamic republic of Iran.

Should any of the services covered by this policy be required the insured, he/she be advised to contact the following centers of Bimeh Iran and let them know his/ her name, surname, policy and passport numbers.

- Bimeh Iran, Executive department of Traveler’s Health Insurance. (Iran Assistance)

Tel: +982186718601 Fax: +982186717369 Email: medical@iraninsurance.ir - Bimeh Iran, Tehran Ferdowsi Branch,

Phone: +982166732558, +982166714488 - Bimeh Iran, Tehran, Executive Section of health Insurance Department , Phone: +982188723191-5

- In the case of failure to contact or receive the due service from Bimeh Iran’s premedical branches, please report the incident to Bimeh Iran, fax: +982166702639 for subsequent actions.

Chapter I

Definitions

- Insured: All foreign nationals visiting Iran, individually or collectively, for such purposes and

Note: The services covered by this policy shall be extended to the insured, individually or collectively, subject to compatibility of the recorded personal details in the policy with those registered in his/her passport.

- Bodily injuries: The injuries caused by spontaneous, sudden, external and visible factors except illnesses, after the insured’s arrival in Iran instigating his/her own or his/her agent’s application for

- Disease: Sudden and unpredictable conditions being contracted, started and originated after the insured’s arrival in Iran, causing his/her own or his/her agent’s application for

- Loss: Any incident leading to supply of the services subject of this

- Dependents: Insured’s father, mother, children, wife, brothers and

- Intensive medical cause: Bodily injury or disease jeopardizing the insured’s good

- Euro: The current monetary unit of European

- Franchise: The portion of medical expenses borne by

- Scope of coverage: The benefits stipulated in chapter II of this contract through the Islamic republic of

- Duration of coverage: The services specified in this contract shall continue solely in Iran for a maximum duration of 92 consecutive

- Statute of limitation: The claims pertaining to this coverage shall be subject to the statute of limitation two years after the date of the due incidents causing such claims

- Subrogation: Bimeh Iran shall subrogate the insured for his/her claims against anyone being liable for the incidents leading to the losses mentioned in the Benefits lists, up to the amount of the borne expenses or the paid

Should all or part of the services extended by Bimeh Iran be covered by a separate scheme, this company shall subrogate the insured in regard of the claim made in relation the said scheme.

Chapter II:

Benefits

- Medical transfer: Should the insured suffer bodily injuries caused by an accident, unexpected disease or mandatory quarantine during the term of this contract, Bimeh Iran shall arrange and pay for the services as follows:

1. Admission of insured to the nearest hospital.

2. Transfer of insured to a more suitable hospital compatible with the nature of the disease or inflicted injuries by necessary and accessible means such as land or air ambulances or planes (According to the available flight schedule, if medically needed.

Imbursement of treatment expenses:

Up to €10000 (or its equivalent in Iranian Rials) for each case of loss during the coverage period.

- Medical expenses which includes insured’s surgical

- Medical emergency expenses which includes initial physician visit, imaging services and laboratory expenses, physiotherapy expenses, medical transferring to related medical centers caused by incidents such as vehicle

- Medical expense caused by poisoning such as food

Franchise: €25(or its equivalent in Iranian Rials) in each case of loss, excluding the cases related to the insured’s bodily injury or hospitalization for a duration of at least 24 hours.

Bimeh Iran commits itself to pay expenses concerning medical emergency cases, food poisoning, medical treatment in hospitals and surgeries undergone by the insured or his/her agent in emergency cases caused by bodily injuries or spontaneous diseases on the basis of medical certification. This commitment does not include any kind of prothesis. However, such payments shall continue as long as the health conditions of the insured are ascertained suitable for repatriation to his respective country by his Iranian medical team as well as the certified physician of Bimeh Iran.

- In the event of medical emergencies Bimeh Iran shall provide the insured with the required information, such as details of the relevant hospitals, restricted surgery clinics and other specialized centers for patients and injured along with the necessary recommendations. Such information shall not include diagnostic and check up

- Repatriation of corpse: In the event of insured decease Bimeh Iran commits itself to take all the requisite measure and pay for the due costs of the preparatory actions and procurement of coffin for subsequent transfer of the corpse to the nearest airport to the designated burial site in the insured’s respective country. However this policy shall not cover the funeral and burial

Repatriation of unaccompanied minors:

Should the insured be unable to undertake the custody of a minor under 15 years of age accompanied him/her at the time of incident, due to his/her medical transfer or repatriation of his/her corpse, Bimeh Iran shall take the necessary measures to secure repatriation of the concerned minor to his/her respective country.

- Juridical comradeship: presenting necessary guides, penal, civil law and Juridical comradeship due to vehicle accidents during his/her stays in Iran up to 250 euro equivalent in I.R.I.

- loss of document: In the case of loss of important travel documents, such as passport, visa stickers, airline tickets… Bimeh Iran will provide insured person with necessary advice in order to supersede mentioned

Undertake attendant’s travel to Iran from country of origin in an emergency:

In the case insured is hospitalized more than 10 days because of illness or accident which is under the coverage of this insurance, Bimeh Iran would pay for travel costs of one of his next of kin from country of origin to Iran.(Transportation costs to the place in which insured is hospitalized)

Chapter III:

General Exclusion

- The services subject of this contract shall be extended only to visitors whose sojourn in Iran lasts less than 92 consecutive

- The insured’s commitments do not cover the medical costs borne, directly or indirectly, by the insured without prior notification and consent of Bimeh Iran (Subject of chapter IV of this contract).

- Other exclusion: The commitment of the insurer subject of this contract are also excluded from the cases as follows:

- Conditions caused by traveling for energy

- Side-effects of the treatments Undergone in the insured’s country of

- Side-effects of preventive measures and

- Side effects of physiotherapy, suntherapy cosmetology and

- Effects of existing diseases, resurgence of chronic diseases or perpetuation of the conditions for which the insured consciously receive treatments. Convalescence is regarded as part of the illness

- Conditions causes by war, military aggressive, alien adversary actions, hostile operations (with or without a declared war), insurgency and terrorist

- Conditions caused by deliberate self-inflicted injuries or participation in criminal

- Conditions caused by the insured’s participation in professional betting, horse racing, cycling and any other sort of motoring competitions or

- Conditions caused by the insured’s participation in fighting, excluding the cases for self- defense.

- Conditions caused by the insured’s participation in professional athletic exercise or the exercises intended for participation in official competition or

- Conditions caused by the radioactive material disintegration or radioactive contamination caused by nuclear fuel radiation or explosive poisonous radioactive materials or hazardous conditions created, directly or indirectly by any explosive nuclear installation or any such nuclear

- Conditions caused by chronic or prolonged diseases or the diseases suffered and for which being treated by the insured prior to the commencement date of the insurance coverage instigating the insured’s or his/her agent’s application for aid from Bimeh Iran The convalescence period is considered as part of the duration of

- Conditions caused by pregnancy during the third quarter prior to the expected date of delivery or by voluntary

- Conditions derived from psychological diseases or

- Conditions caused by the total or partial effects of alcoholic beverages, psychotropic and narcotic drugs consumptions, excluding the drugs being prescribed and consumed under the auspices of a competent

- Conditions caused by death, bodily injuries or diseases due to suicide or suicidal

- Conditions caused by the insured’s participation in professional contests, climbing (if rope or guide is needed), cave climbing, scuba diving, winter sports, aviation or any sort of flight, excluding the cases when the insured flies in the capacity of a passenger of an authorized plane administered by a licensed commercial aviation agent or under the ownership and management of commercial

- Accidents caused by hard and hazardous labor, such as construction

- Congenital and related diseases and

Chapter IV:

Insured’s commitments

– General Procedure

- Application for aid: In emergency cases the insured is required to contact the nearest round-the-clock aid center of Bimeh Iran, prior to any personal initiative, to provide them with the following:

1-1. Full name of the insured, number and validity period of concerned policy.

1-2. Insured’s address of residence in Iran along with his/her phone number.

1-3. Brief description of the accident or diseases and the type of the needed aid.

– Timely contact with Bimeh Iran.

- Notification of claims: Claims shall be notified not later than 72 hours after the beginning of hospitalization or medical consultations. The claims that are notified after the lapse of the above-mentioned Time-Limit shall be null and

- The cases encountered with fatal conditions: Notwithstanding the above article and the content of this contract, should the insured or his/her agent be encountered with fatal conditions arrangement must be made for their immediate transfer to the nearest hospital followed by reporting of the case to Bimeh Iran at the earliest opportunity. In such cases notification to Bimeh Iran shall not exceed 45 hours after the emergence of the fatal disease or occurrence of the accident. Failure to comply with this instruction may authorize Bimeh Iran to claim the costs incurred for such delay by the.

– General conditions:

- Restriction: upon the occurrence of loss the insured shall take all the required measures to ensure further expansion of its effects.

- Recovery: In appropriate cases, the insured shall furnish Bimeh Iran with all the documents and proceeding in order to enable the latter to recover the due losses from the relevant

Important notes:

- Commencement of insurance coverage coincides with the date of your arrival in the Islamic republic of Iran as indicated in your passport

- The cost of canceling this policy, given the insured is unable to embark on the trip due to his/her failure to secure the required Iranian entry visa, is € 2 which in other cases is €3.

- All claims shall be payable in the Iranian Rial or foreign currencies only in place where the accident takes place or disease

- The insured shall not be indemnified against the expenses made by his/he own initiative, without securing prior agreement of Bimeh

- All claims shall be notified to Bimeh Iran within 72 hours after the insured’s admission to a hospital or his/her initiative to receive medical consultation. The claims reported after the set deadline shall be considered ineffective.

- Whenever aid is needed please inform the nearest branch of Bimeh Iran to your place of residence or the accident site in Iran of your name, surname, policy number and date of its validity, passport number, address, phone number, a brief description of the encountered problem and the type of required relief

6.1. Bimeh Iran, Ferdowsi Branch, Phone: +982166714488, +982166732558

6.2. Bimeh Iran, Executive Section of Health Insurance Department, Phone: +982188723191-5 - The policies issued for multiple trips are valid for specified duration, provided each trip does not exceed 92 consecutive

- Medical costs for the incidents caused by high-risk labor, such as construction works are excluded from this insurance

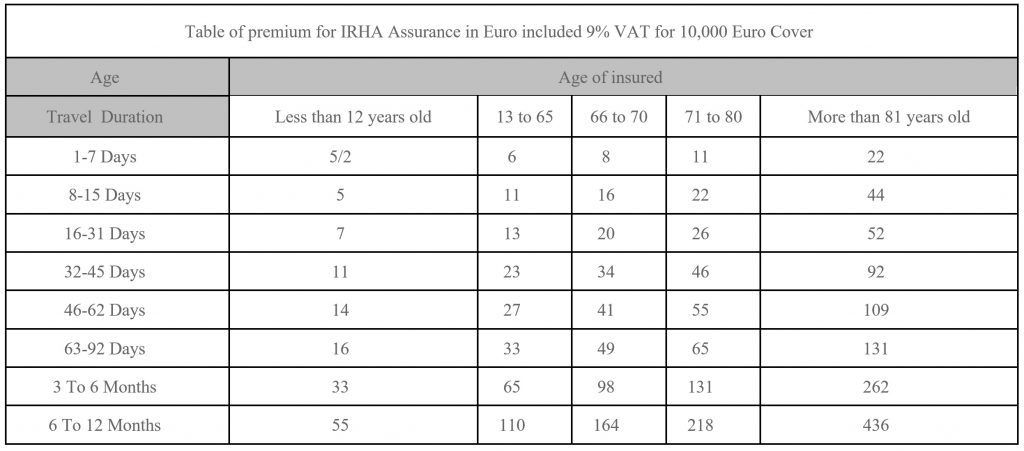

Bellow table is premium for 10,000 Euro Coverage . people living in some specified countries can choose less coverage and premium.

TRAVEL INSURANCE REQUEST FORM

2. This policy would not be cancelled if validity of the visa is not expired.

3. The validity of the policy begins on the date of the client's first entrance to Iran as indicated in the passport. This section will be completed by the insurance agent.